Each week, I share my favorite posts for the week. Here is the weekly roundup for Feb 26th -Mar 3rd: My Favorite Posts of the Week: Karl at Cult of Money wrote about Lifestyle trade-offs – Hurray for diabetes? Emily at Evolving Personal Finance discussed the urge to spend in Do You Ever Just Give In and Spend? SB at Finance Product Reviews reviewed the Best Buy Reward Zone Credit Card Review – Avoid the Zone Financial Knowledge Online shared their Monthly Income Report February 2012 Jefferson at See Debt Run wrote about some old habits in Habit Creep Kris...

Personal and Blog Goals for 2012

Personal Goals Get accepted to the Tepper School of Business (Carnegie Mellon) and the Katz School of Business (University of Pittsburgh) and enroll in one of the programs in the Fall of 2012 (August) Start creating detailed budgets and track all of my spending on a monthly basis. I started tracking my spending when I started my last blog and I had things very organized. I got a little lazy and stopped tracking, so I want to start tracking my spending again. Continue building a down payment fund for a new house. I have been looking at houses recently and...

The Saver’s Credit: Do You Qualify?

My girlfriend asked me to help her with her taxes this year because it was the first time she had a job paying any substantial wages. At the end of the year, she was curious how much she would get back as a refund, so I used one of the calculators online to come up with a refund estimate for her. However, when we did her taxes in February, we were delighted to find that she was getting a lot more back than we expected. This is because of something known as the Saver’s Credit. The saver’s credit is something...

Weekly Roundup #1

Favorite Posts of the Week: JT at MoneyMamba discusses his favorite metric to evaluate a business – CROIC Justin at Money Is The Root wrote about why Education is the Key to Success. I completely a agree and am a big proponent of graduate degrees. Andrea at So Over Debt wrote a post about Getting Out of Debt is Like Using a Public Restroom. This is a great analogy and you should check out the post! Congratulations to Krystal at Give Me Back My Five Bucks for reaching 5 years blogging! LaTisha at Financial Success for Young Adults wrote a...

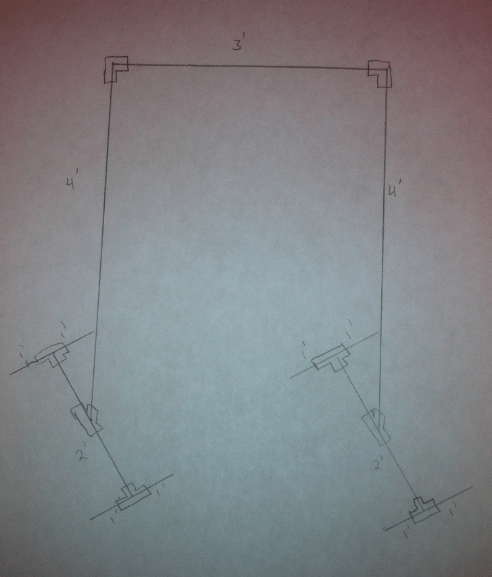

Building a Grow Light Stand

It’s the time of the year that I start my vegetables by seed indoors. I have an indoor grow light that I use to grow my plants for a few months before transplanting them outside. I always start my plants by seed because I like to have full control and grow the varieties that I want. Also, I save a lot of money on vegetables in the summer because of my garden! This year, I needed to come up with a new stand for my light. In the past, I just used a few pieces of wood to put it...

Gen Y Finances Joined the Yakezie Challenge

This is my second blog, so I know the benefits of the Yakezie community and really enjoyed supporting everybody involved with Yakezie! With that in mind, I decided that I would join Gen Y Finances in the Yakezie challenge. If you’re not familiar with the Yakezie challenge, it is a challenge to get your blog into the top 200,000 in the Alexa rankings in 6 months. Additionally, Yakezie is about supporting other bloggers and selflessly promoting them. I’m excited to have Gen Y Finances in the challenge and look forward to communicating with Yakezie members and challengers over the coming...

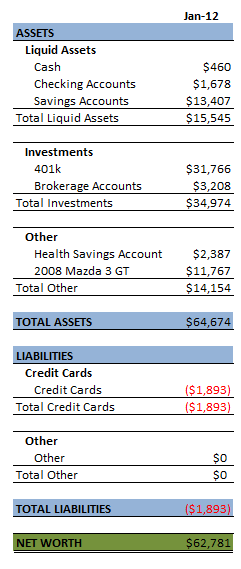

January 2012 Personal Balance Sheet

Below is a look at my personal balance sheet as of January 31, 2012. This is the template that I will use every month for my blog posts. I will likely have more details on my spending and income starting with my March 2012 balance sheet. The balance sheet could have some changes to it sometime in 2012. I am looking to buy a house while both interest rates and housing prices are low. I’ve been looking for at houses for a little over a month now, but the right house just hasn’t come up yet. I will post more...

Welcome To My Blog!

Hi Everyone! I’m Dave and this is my first post at my new blog Gen Y Finances. This is actually the second blog that I started. I started a blog back in February of 2011, but decided to sell it mid-year because of some personal problems and time constraints. However, I’m back and ready to blog again. I will try to cover a wide range of topics on this blog related to Generation Y. The topics will cover personal finance, investing, business school, technology, sports, gardening, and a variety of other subjects. One of the staples of the blog that...